Sun Country Air 🇺🇸

NASDAQ: SNCY • EV: $828M • Last Close: $14.54

Sun Country Airlines is a low cost airline primarily serving the Minneapolis St. Paul Airport (MSP). They only run Boeing 737 aircraft, reducing maintenance and crew complexity.

Sun Country partnered with Amazon to run and maintain all 20 of their Boeing 737’s. As this contract ramps, Sun Country expects revenues of $230-240 million by ~2027 which should produce around $40M of additional FCF.

Sun Country has intentionally idled planes as they focus resources on the Amazon contract. Once the Amazon contract is in full swing and the rest of the fleet gets back to normal utilization, the company expects $2.50 of run-rate earnings.

A Recent VIC Writeup (Link).

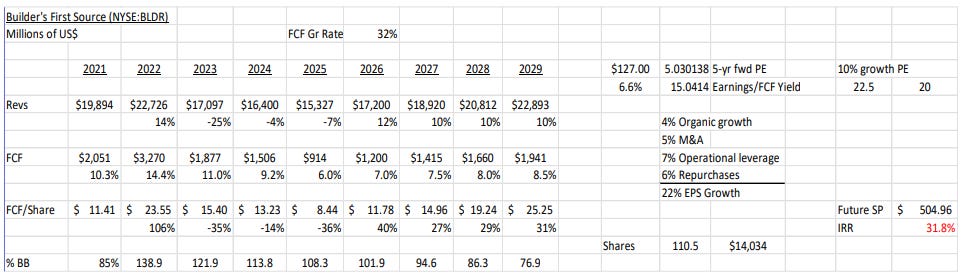

Builders FirstSource 🇺🇸

NYSE: BLDR • EV: $15.5B • Last Close: $104.03

Builders FirstSource is the result of a 27 year roll-up of lumber and building materials dealers and are now the largest building materials distributer in the US. BLDR has focused on and grown their higher quality value-add business (pre-assembly and installation services) significantly since the GFC.

BLDR will continue to roll-up smaller players which with their scale synergies create great returns on investment. They are also a share cannable

“Since the inception of its buyback program in August 2021, the Company has repurchased 99.3 million shares of its common stock, or 48.1% of its total shares outstanding, at an average price of $80.90 per share for a total cost of $8.0 billion, inclusive of applicable fees and taxes.”

Shares trade for 9% FCF yield, in a more normalized housing market this would be 10-15%.

Check Out: Graham Duncan: Talent Whisperer

Disclosure: This newsletter does not provide investment advice. Information presented is for informational purposes only and should not be considered a recommendation to buy or sell securities. The author may or may not own the securities discussed.