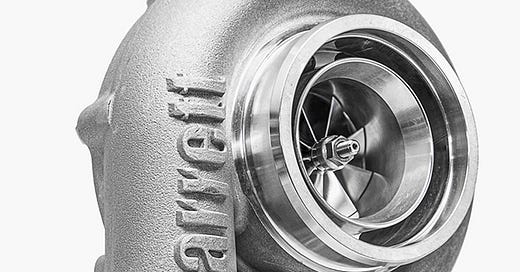

Garret Motion 🇺🇸 (NASDAQ: GTX, EV: $3.2B, Last Close: $9.21)

Garret Motion is a leading manufacturer of turbochargers. Turbochargers are highly engineered with Garret and Borgwarner operating in duopoly allowing for high margins and nice ROIC’s. As turbochargers are not used in EV’s, there is a concern over Garret’s terminal value that has shares trading for 5x FCF. ~40% of Garrets business is generated from commercial vehicles and replacements with little terminal risk, while turbochargers continue to gain share in new ICE vehicles. Meanwhile all FCF is going towards buybacks.

Asaka Industrial 🇯🇵 (TYO: 5962, EV: ¥1.3B, Last Close: ¥1,571)

Asaka Industrial is a 350 year old company. Today, they are the largest manufacturer of Japanese made shovels and scoops. Over the last 10 years they’ve averaged ¥131M in earnings. Shares trade for 0.46x of net current assets + investments, and 0.31x of book value.

A Writeup from Altay Cap (Link).

Imperial Metals 🇨🇦 (TSX: III, EV: $880M, Last Close: $3.59)

Imperial is an open pit Canadian copper and gold producer. They own Mount Polley which was restarted in 2022 and profitable well below today’s metals prices. They also own 30% of the Red Chris mine with an estimated NPV of $2.3B at $1500/oz gold and $3.3/lb copper. Both mines have visibility to $100M+ in FCF in the medium term, while Red Chris should be able to get closer to $400M over the long term.

A VIC Writeup With More Info on the Numbers Above (Link).

Check Out: A Letter a Day: College Admissions Essays

Disclosure: This newsletter does not provide investment advice. Information presented is for informational purposes only and should not be considered a recommendation to buy or sell securities. The author may or may not own the securities discussed.