Portfolio Change: Adyen Out, ODET In

I've exited my position in Adyen after strong earnings last week and rotated the proceeds into Compagnie De l'odet.

Having admired Adyen for a number of years, I jumped at the opportunity to buy shares in August of 2023 after a sharp sell off post H2 earnings. My cost basis worked out to €800, about 30x my estimate of owners earnings. Adyen’s management is about as good as it gets, and they’re riding a massive digital payments wave. For these reasons, among others, I intended to hold Adyen for a much longer period of time. However, Adyen’s shares have quickly run back up, now trading for €1800 and over 60x my estimate of owners earnings. Never the less, I suspect selling Adyen will prove to be a bad decision in the long-term. So why did I sell?

It comes down to opportunity cost. Another company I’ve admired for some time is Compagnie De l'odet (ODET). Simply put, I believe that not buying ODET is a bigger mistake than selling Adyen.

Compagnie De l'odet

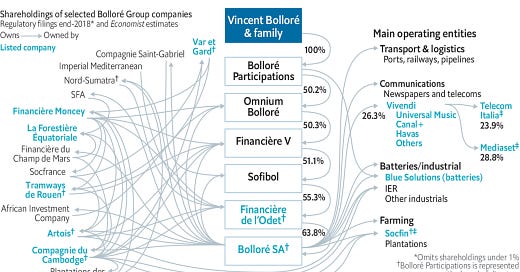

I view ODET as the best option to buy into the Bollore universe of companies. The Bollore universe is a complicated one, for further reading I’d recommend Carsten Mueller’s writeup, as well as East 72’s writings. Zooming out, an investment in ODET boils down to the following components.

A stake in Universal Music Group currently worth €2480/share. This is a great business and is effectively a royalty on the consumption of music.

A stake in Vivendi, which recently split into 4 separately listed holdings, collectively trading for €830/share, and worth significantly more.

A net cash position worth €1510/share.

Add up the above, and ODET is trading at just 32% of it’s adjusted NAV. The majority of this NAV is made up of i) cash in the hands of good capital allocators, and ii) a stake in UMG, which will continue to compound earnings power at double digits well into the future. And finally, with the second generation getting ready to take the reigns and regulatory changes omitting the need for a confusing circular ownership structure, the Bollore family is actively taking steps to close the NAV discount.

How are they taking steps to close the NAV discount?